The Conversion Cycle:Accounting in a Lean Manufacturing Environment

Accounting in a Lean Manufacturing Environment

The lean manufacturing environment carries profound implications for accounting. Traditional information produced under conventional accounting techniques does not adequately support the needs of lean companies. They require new accounting methods and new information that:

1. Shows what matters to its customers (such as quality and service).

2. Identifies profitable products.

3. Identifies profitable customers.

4. Identifies opportunities for improvement in operations and products.

5. Encourages the adoption of value-added activities and processes within the organization and identifies those that do not add value.

6. Efficiently supports multiple users with both financial and nonfinancial information.

In this section, we examine the nature of the accounting changes under way. The discussion reviews the problems associated with standard cost accounting and outlines two alternative approaches: (1) activity-based costing and (2) value stream accounting.

WHAT’S WRONG WITH TRADITIONAL ACCOUNTING INFORMATION?

Traditional standard costing techniques emphasize financial performance rather than manufacturing performance. The techniques and conventions used in traditional manufacturing do not support the

objectives of lean manufacturing firms. The following are the most commonly cited deficiencies of standard accounting systems.

INACCURATE COST ALLOCATIONS. An assumption of standard costing is that all overheads need to be allocated to the product and that these overheads directly relate to the amount of labor required to make the product. A consequence of automation is the restructuring of manufacturing cost patterns. Figure 7-19 shows the changing relationship between direct labor, direct materials, and overhead cost under different levels of automation. In the traditional manufacturing environment, direct labor is a much larger component of total manufacturing costs than in the CIM environment. Overhead, on the other hand, is a far more significant element of cost under automated manufacturing. Applying standard costing leads to product cost distortions in a lean environment, causing some products to appear to cost more and others to appear to cost less than they actually do. Poor decisions regarding pricing, valuation, and profitability may result.

PROMOTES NONLEAN BEHAVIOR. Standard costing motivates nonlean behavior in operations. The primary performance measurements used in standard costing are personal efficiency of production workers, the effective utilization of manufacturing facilities, and the degree of overhead absorbed by production. In addition, standard costing conceals waste within the overhead allocations and is difficult to detect. To improve their personal performance measures, management and operations employees are inclined to produce large batches of products and build inventory. This built-in motivation is in conflict with lean manufacturing.

TIME LAG. Standard cost data for management reporting are historic in nature. Data lag behind the actual manufacturing activities on the assumption that control can be applied after the fact to correct errors. In a lean setting, however, shop floor managers need immediate information about abnormal deviations. They must know in real time about a machine breakdown or a robot out of control. After-the- fact information is too late to be useful.

FINANCIAL ORIENTATION. Accounting data use dollars as a standard unit of measure for comparing disparate items being evaluated. Decisions pertaining to the functionality of a product or process, improving product quality, and shortening delivery time, however, are not necessarily well served by financial information produced through standard cost techniques. Indeed, attempts to force such data into a common financial measure may distort the problem and promote bad decisions.

ACTIVITY-BASED COSTING (ABC)

Many lean manufacturing companies have sought solutions to these problems through an accounting model called activity-based costing (ABC). ABC is a method of allocating costs to products and services to facilitate better planning and control. It accomplishes this by assigning cost to activities based on their use of resources and assigning cost to cost objects based on their use of activities. These terms are defined below:

Activities describe the work performed in a firm. Preparing a purchase order, readying a product for shipping, or operating a lathe are examples of activities.

Cost objects are the reasons for performing activities. These include products, services, vendors, and customers. For example, the task of preparing a sales order (the activity) is performed because a customer (the cost object) wishes to place an order.

The underlying assumptions of ABC contrast sharply with standard cost accounting assumptions. Traditional accounting assumes that products cause costs. ABC assumes that activities cause costs, and products (and other cost objects) create a demand for activities.

The first step in implementing the ABC approach is to determine the cost of the activity. The activity cost is then assigned to the relevant cost object by means of an activity driver. This factor measures the activity consumption by the cost object. For example, if drilling holes in a steel plate is the activity, the number of holes is the activity driver.

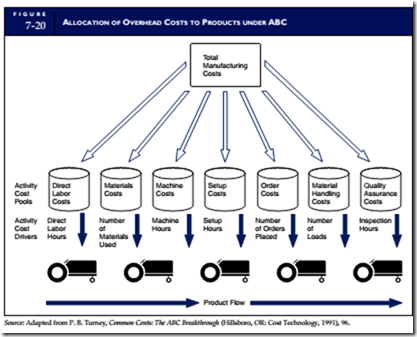

Traditional accounting systems often use only one activity driver. For instance, overhead costs, collected into a single cost pool, are allocated to products on the basis of direct labor hours. A company using ABC may have dozens of activity cost pools, each with a unique activity driver. Figure 7-20 illustrates the allocation of overhead costs to products under ABC.

Advantages of ABC

ABC allows managers to assign costs to activities and products more accurately than standard costing permits. Some advantages that this offers are:

• More accurate costing of products/services, customers, and distribution channels.

• Identifying the most and least profitable products and customers.

• Accurately tracking costs of activities and processes.

• Equipping managers with cost intelligence to drive continuous improvements.

• Facilitating better marketing mix.

• Identifying waste and non–value-added activities.

Disadvantages of ABC

ABC has been criticized for being too time-consuming and complicated for practical applications over a sustained period. The task of identifying activity costs and cost drivers can be a significant undertaking that is not completed once and then forgotten. As products and processes change, so do the associated activity costs and drivers. Unless significant resources are committed to maintaining the accuracy of activity costs and the appropriateness of drivers, cost assignments become inaccurate. Critics charge that rather than promoting continuous improvement, ABC creates complex bureaucracies within organizations that are in conflict with the lean manufacturing philosophies of process simplification and waste elimination.

VALUE STREAM ACCOUNTING

The complexities of ABC have caused many firms to abandon this method in favor of a simpler accounting model called value stream accounting. Value stream accounting captures costs by value stream rather than by department or activity, as illustrated in Figure 7-21.

Notice that value streams cut across functional and departmental lines to include costs related to marketing, selling expenses, product design, engineering, materials purchasing, distribution, and more. An essential aspect in implementing value stream accounting is defining the product family. Most organizations produce more than one product, but these often fall into natural families of products. Product families share common processes from the point of placing the order to shipping the finished goods to the customer. Figure 7-22 illustrates how multiple products may be grouped into product families.

Value stream accounting includes all the costs associated with the product family, but makes no distinction between direct costs and indirect costs. Raw material costs are calculated based on how much material has been purchased for the value stream, rather than tracking the input of the raw material to specific products. Thus, the total value stream material cost is the sum of everything purchased for the period. This simplified (lean) accounting approach works because RM and WIP inventories on hand are low, representing perhaps only one or two days of stock. This approach would not work well in a traditional manufacturing environment in which several months of inventory may carry over from period to period.

Labor costs of employees who work in the value stream are included whether they design, make, or simply transport the product from cell to cell. Labor costs are not allocated to individual products in the traditional way (time spent on a particular task). Instead, the sum of the wages and direct benefits paid to

all individuals working in the value stream is charged to the stream. Support labor such as maintenance of machines, production planning, and selling are also included. Wherever possible, therefore, each employee should be assigned to a single value stream, rather than having their time split among several different streams.

Typically, the only allocated cost in the value stream is a charge per square foot for the value stream production facility. This allocation would include the cost of rent and building maintenance. The logic behind this is to promote efficiency by encouraging value stream team members to minimize the space used to operate the value stream. General overhead costs incurred outside the value stream, which cannot

be controlled by the value stream team, are not attached to the product family. Thus, no attempt is made to fully absorb facilities costs. Although corporate overhead costs must be accounted for, they are not allocated to value streams.

Comments

Post a Comment