Purchases and Cash Disbursements Procedures:Computer-Based Purchases and Cash Disbursements Applications.

Computer-Based Purchases and Cash Disbursements Applications

Now that we have covered the fundamental operational tasks and controls that constitute the expenditure cycle, let’s examine the role of computers. In Chapter 4 we presented a technology continuum with automation at the low end and reengineering at the high end. Recall that automation involves using technology to improve the efficiency and effectiveness of a task, while the objective of reengineering is to eliminate nonvalue–added tasks. Reengineering involves replacing traditional procedures with innovative procedures that are often very different from those previously in place. In this section we see how both automation and reengineering techniques apply in purchases and cash disbursement systems.

AUTOMATING PURCHASES PROCEDURES USING BATCH PROCESSING TECHNOLOGY

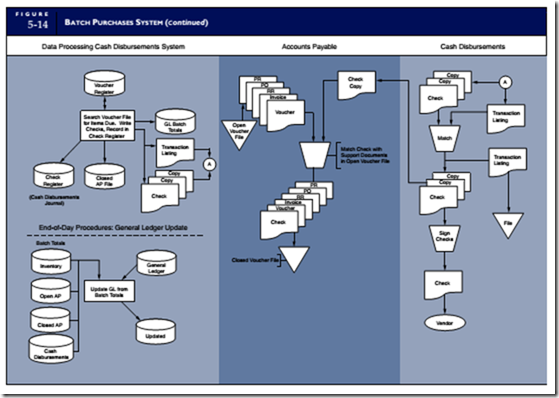

The automated batch system presented in Figure 5-14 has many manual procedures similar to those presented in Figure 5-12. The principal difference is that accounting (bookkeeping) tasks are now automated. The following section describes the sequence of events as they occur in this system.

Data Processing Department: Step 1

The purchasing process begins in the data processing department, where the inventory control function is performed. When inventories are reduced by sales to customers or usage in production, the system deter- mines if the affected items in the inventory subsidiary file have fallen to their reorder points.4 If so, a re- cord is created in the open purchase requisition file. Each record in the requisition file defines a separate inventory item to be replenished. The record contains the inventory item number, a description of the item, the quantity to be ordered, the standard unit price, and the vendor number of the primary supplier. The information needed to create the requisition record is selected from the inventory subsidiary record, which is then flagged ‘‘On Order’’ to prevent the item from being ordered again before the current order arrives. Figure 5-15 shows the record structures for the files used in this system.

At the end of the day, the system sorts the open purchase requisition file by vendor number and consolidates multiple items from the same vendor onto a single requisition. Next, vendor mailing information is retrieved from the valid vendor file to produce hard copy purchase requisition documents, which go to the purchasing department.

Purchasing Department

Upon receipt of the purchase requisition, the purchasing department prepares a multipart PO. Copies are sent to the vendor, AP, receiving, data processing, and the purchasing department’s file.

The system in Figure 5-14 employs manual procedures as a control over the ordering process. A computer program identifies inventory requirements and prepares traditional purchase requisitions, but the purchasing agent reviews the requisitions before placing the order. Some firms do this to reduce the risk of placing unnecessary orders with vendors because of a computer error. Such manual interven- tion, however, does create a bottleneck and delays the ordering process. If sufficient computer controls are in place to prevent or detect purchasing errors, then more efficient ordering procedures can be implemented.

Before continuing with our example, we need to discuss alternative approaches for authorizing and ordering inventories. Figure 5-16 illustrates three common methods.

In alternative one, the system takes the procedures shown in Figure 5-14 one step further. This system

automatically prepares the PO documents and sends them to the purchasing department for review and

signing. The purchasing agent then mails the approved POs to the vendors and distributes copies to other internal users.

Alternative two expedites the ordering process by distributing the POs directly to the vendors and internal users, thus bypassing the purchasing department completely. Instead, the system produces a trans- action list of items ordered for the purchasing agent’s review.

Alternative three represents a reengineering technology called electronic data interchange. The concept was introduced in Chapter 4 to illustrate its application to the revenue cycle. This method produces no physical POs. Instead, the computer systems of both the buying and selling companies are connected via a dedicated telecommunications link. The buyer and seller are parties to a trading partner arrangement in which the entire ordering process is automated and unimpeded by human intervention.

In each of the three alternatives, the tasks of authorizing and ordering are integrated within the computer system. Because physical purchase requisitions have no purpose in such a system, they are not produced. Digital requisition records, however, would still exist to provide an audit trail.

Data Processing Department: Step 2

As explained in Figure 5-14, a copy of the PO is sent to data processing and used to create a record in the open PO file. The associated requisitions are then transferred from the open purchase requisition file to the closed purchase requisition file.

Receiving Department

When the goods arrive from vendors, the receiving clerk prepares a receiving report and sends copies to the stores (with the goods), purchasing, AP, and data processing.

Data Processing Department: Step 3

The data processing department creates the receiving report file from data provided by the receiving report documents. Then a batch program updates the inventory subsidiary file from the receiving report file. The program removes the ‘‘On Order’’ flag from the updated inventory records and calculates batch totals of inventory receipts, which will later be used in the general ledger update procedure. Finally, the associated records in the open PO file are transferred to the closed PO file.

Accounts Payable

When the AP clerk receives the supplier’s invoice, he or she reconciles it with the supporting documents that were previously placed in the AP pending file. The clerk then prepares a voucher, files it in the open voucher file, and sends a copy of the voucher to data processing.

Data Processing Department: Step 4

The voucher file is created from the voucher documents. A batch program validates the voucher records against the valid vendor file and adds them to the voucher register (open AP subsidiary file). Finally, batch totals are prepared for subsequent posting to the AP control account in the general ledger.

CASH DISBURSEMENTS PROCEDURES

Data Processing Department

Each day, the system scans the DUE DATE field of the voucher register (see Figure 5-15) for items due. Checks are printed for these items, and each check is recorded in the check register (cash disbursements journal). The check number is recorded in the voucher register to close the voucher and transfer the items to the closed AP file. The checks, along with a transaction listing, are sent to the cash disbursements department. Finally, batch totals of closed AP and cash disbursements are prepared for the general ledger update procedure.

At the end of the day, batch totals of open (unpaid) and closed (paid) AP, inventory increases, and cash disbursements are posted to the AP control, inventory control, and cash accounts in the general ledger. The totals of closed AP and cash disbursements should balance.

Cash Disbursements Department

The cash disbursements clerk reconciles the checks with the transaction listing and submits the negotiable portion of the checks to management for signing. The checks are then mailed to the suppliers. One copy of each check is sent to AP, and the other copy is filed in cash disbursements, along with the transaction listing.

Accounts Payable Department

Upon receipt of the check copies, the AP clerk matches them with open vouchers and transfers these now closed items to the closed voucher file. This concludes the expenditure cycle process.

REENGINEERING THE PURCHASES/CASH DISBURSEMENTS SYSTEM

The automated system described in the previous section simply replicates many of the procedures in a manual system. In particular, the AP task of reconciling supporting documents with supplier invoices is labor-intensive and costly. The following example shows how reengineering this activity can produce considerable savings.

The Ford Motor Company employed more than 500 clerks in its North American AP department. Analysis of the function showed that a large part of the clerks’ time was devoted to reconciling discrepancies among supplier invoices, receiving reports, and POs. The first step in solving the problem was to change the business environment. Ford initiated trading partner agreements with suppliers in which they agreed in advance to terms of trade such as price, quantities to be shipped, discounts, and lead times. With these sources of discrepancy eliminated, Ford reengineered the work flow to take advantage of the new environment. The flowchart in Figure 5-17 depicts the key features of a reengineered system.

Data Processing

The following tasks are performed automatically.

1. The inventory file is searched for items that have fallen to their reorder points.

2. A record is entered in the purchase requisition file for each item to be replenished.

3. Requisitions are consolidated according to vendor number.

4. Vendor mailing information is retrieved from the valid vendor file.

5. Purchase orders are prepared and added to the open PO file.

6. A transaction listing of POs is sent to the purchasing department for review.

Receiving Department

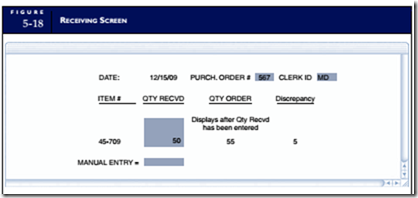

When the goods arrive, the receiving clerk accesses the open PO file in real time by entering the PO number taken from the packing slip. The receiving screen, illustrated in Figure 5-18, then prompts the clerk to enter the quantities received for each item on the PO.

Data Processing

The following tasks are performed automatically by the system.

1. Quantities of items received are matched against the open PO record, and a Y value is placed in a logical field to indicate the receipt of inventories.

2. A record is added to the receiving report file.

3. The inventory subsidiary records are updated to reflect the receipt of the inventory items.

4. The general ledger inventory control account is updated.

5. The record is removed from the open PO file and added to the open AP file, and a due date for pay- ment is established.

Each day, the DUE DATE fields of the AP records are scanned for items due to be paid. The following procedures are performed for the selected items.

1. Checks are automatically printed, signed, and distributed to the mail room for mailing to vendors.

EDI vendors receive payment by electronic funds transfer (EFT). EFT is discussed in the appendix to Chapter 12.

2. The payments are recorded in the check register file.

3. Items paid are transferred from the open AP file to the closed AP file.

4. The general ledger AP and cash accounts are updated.

5. Reports detailing these transactions are transmitted via terminal to the AP and cash disbursements departments for management review and filing.

Because the financial information about purchases is known in advance from the trading partner agree- ment, the vendor’s invoice provides no critical information that cannot be derived from the receiving

report. By eliminating this source of potential discrepancy, Ford was able to eliminate the task of reconciling vendor invoices with the supporting documents for the majority of purchase transactions. As a result of its reengineering effort, Ford was able to reduce its AP staff from 500 to 125.

CONTROL IMPLICATIONS

The general control issues raised in Chapter 4 pertain also to the expenditure cycle and are not revisited here. A full treatment of this material is provided in Chapters 15 through 17. In the following section we examine only the issues specific to the expenditure cycle by focusing on the differences between an auto- mated and a reengineered system.

The Automated System

IMPROVED INVENTORY CONTROL. The greatest advantage of the automated system over its manual counterpart is improved ability to manage inventory needs. Inventory requirements are detected as they arise and are processed automatically. As a result, the risks of accumulating excessive inventory or of running out of stock are reduced. With this advantage, however, comes a control concern. Authori- zation rules governing purchase transactions are embedded within a computer program. Program errors or flawed inventory models can cause firms to find themselves suddenly inundated with inventories or desperately short of stock. Therefore, monitoring automated decisions is extremely important. A well- controlled system should provide management with adequate summary reports about inventory purchases, inventory turnover, spoilage, and slow-moving items.

BETTER CASH MANAGEMENT. The automated system promotes effective cash management by scanning the voucher file daily for items due, thus avoiding early payments and missed due dates. In addi- tion, by writing checks automatically, the firm reduces labor cost, saves processing time, and promotes accuracy.

To control against unauthorized payments, all additions to the voucher file should be validated by comparing the vendor number on the voucher against the valid vendor file. If the vendor number is not on file, the record should be diverted to an error file for management review.

In this system, a manager in the cash disbursements department physically signs the checks, thus pro- viding control over the disbursement of cash. Many computer systems, however, automate check signing, which is more efficient when check volume is high. This, naturally, injects risk into the process. To offset this exposure, firms set a materiality threshold for check writing. Checks in amounts below the threshold are signed automatically, while those above the threshold are signed by an authorized manager or the treasurer.

TIME LAG. A lag exists between the arrival of goods in the receiving department and recording inventory receipts in the inventory file. Depending on the type of sales order system in place, this lag may negatively affect the sales process. When sales clerks do not know the current status of inventory, sales may be lost.

PURCHASING BOTTLENECK. In this automated system, the purchasing department is directly involved in all purchase decisions. For many firms this creates additional work, which extends the time lag in the ordering process. A vast number of routine purchases could be automated, thus freeing purchasing agents from routine work such as preparing POs and mailing them to the vendors. Attention can then be focused on problem areas (such as special items or those in short supply), and the purchasing staff can be reduced.

EXCESSIVE PAPER DOCUMENTS. The automated system is laden with paper documents. All operations departments create documents, which are sent to data processing, and which data processing must then convert to magnetic media. Paper documents add costs because they must be purchased, stored, prepared, handled by internal mail carriers, and converted by data processing personnel. Organizations with high volumes of transactions benefit considerably from reducing or eliminating paper documents in their systems.

The Reengineered System

The reengineered system addresses many of the operational weaknesses associated with the automated system. Specifically, the improvements in this system are that (1) it uses real-time procedures and direct access files to shorten the lag time in record keeping, (2) it eliminates routine clerical procedures by distributing terminals to user areas, and (3) it achieves a significant reduction in paper documents by using digital communications between departments and by digitally storing records. These operational improvements, however, have the following control implications.

SEGREGATION OF DUTIES. This system removes the physical separation between authorization and transaction processing. Here, computer programs authorize and process POs as well as authorize and issue checks to vendors. To compensate for this exposure, the system provides management with detailed transaction listings and summary reports. These documents describe the automated actions taken by the system and allow management to spot errors and any unusual events that warrant investigation.

ACCOUNTING RECORDS AND ACCESS CONTROLS. Advanced systems maintain accounting records on digital storage media, with little or no hard-copy backup. Sarbanes-Oxley legislation requires organization management to implement adequate control security measures to protect accounting records from unauthorized access and destruction.

Comments

Post a Comment