Financial Reporting and Management Reporting Systems:XBRL—Reengineering Financial Reporting

XBRL—Reengineering Financial Reporting

Online reporting of financial data has become a competitive necessity for publicly traded organizations. Currently, most organizations accomplish this by placing their financial statements and other financial reports on their respective Web sites as HTML (Hyper Text Markup Language1) documents. These documents can then be downloaded by users such as the SEC, financial analysts, and other interested parties. The HTML reports, however, cannot be conveniently processed through IT automation. Performing any analysis on the data contained in the reports requires them to be manually entered into the user’s information system.

The solution to this problem is eXtensible Business Reporting Language (XBRL), which is the Internet standard specifically designed for business reporting and information exchange. The objective of XBRL is to facilitate the publication, exchange, and processing of financial and business information. XBRL is a derivative of another Internet standard called XML (eXtensible Markup Language).

XML

XML is a metalanguage for describing markup languages. The term extensible means that any markup language can be created using XML. This includes the creation of markup languages capable of storing data in relational form in which tags (or formatting commands) are mapped to data values. Thus, XML can be used to model the data structure of an organization’s internal database.

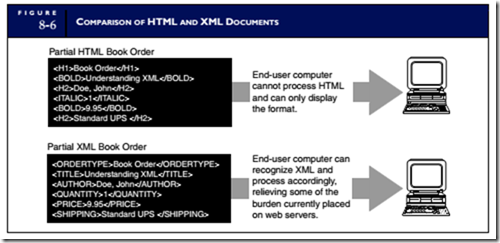

The examples illustrated in Figure 8-6 serve to distinguish HTML from XML using a bookstore order formatted in both languages. Although essentially the same information is contained in both examples and they look similar in structure, important differences exist between them. Although both examples use tags (words that are bracketed by the symbols < and >) and attributes such as Doe, John, the way in which these tags and attributes are used differs. In the HTML example, the tags have predefined meaning that describes how the attributes will be presented in a document. The book order in this example can only be viewed visually (similar to a FAX) and must be manually entered into the bookstore’s order entry system for processing. In the case of the XML order, the tags are customized to the user, and the user’s application can read and interpret the tagged data. Thus, the bookstore order prepared in XML presents

order attributes in a relational form that can be automatically imported into a bookseller’s internal database.

XBRL

Recognizing the potential benefits of XML, the AICPA encouraged research into the creation of an accounting-specific markup language. XBRL is a XML-based language that was designed to provide the financial community with a standardized method for preparing, publishing, and automatically exchanging financial information, including financial statements of publicly held companies. XBRL is typically used for reporting aggregated financial data, but can also be applied to communicating information pertaining to individual transactions. Figure 8-7 presents an overview of the XBRL reporting process, the key elements of which are discussed in the following sections.

The first step in the process is to select a XBRL taxonomy. Taxonomies are classification schemes that are compliant with XBRL specifications to accomplish a specific information exchange or reporting objective such as filing with the SEC. In essence, the XBRL taxonomy specifies the data to be included in an exchange or report. The XBRL Standards Committee has created several taxonomies for widespread use. The illustrations in Figures 8-8 through 8-11 are based on XBRL Taxonomy for Financial Reporting for Commercial and Industrial Companies, referred to as CI taxonomy.2

The next step is to cross-reference each account in the reporting organization’s general ledger to an appropriate XBRL taxonomy element (tag). Figure 8-8 presents part of a hypothetical company’s internal database.3 This snapshot shows various GL accounts and their values. Currently, these data are organized and labeled according to the reporting company’s internal needs and conventions. To make the data useful to outsiders and comparable with other firms, they need to be organized, labeled, and reported in a manner that all XBRL users generally accept. This involves mapping the organization’s internal data to XBRL taxonomy elements.

The mapping process is accomplished using a simple tool such as Taxonomy Mapper, pictured in Figure 8-9.4 Note how the XBRL tag labeled Cash, Cash Equivalents, and Short Term Investments is mapped to the database account labeled Cash in Bank–Canada.

Once the mapping process is complete, each database record will contain a stored tag as depicted by the Taxonomy Element field in Figure 8-10.

Data mapping needs to be done only once, but the embedded tags are used whenever the data are placed in XBRL format for dissemination to outsiders. This allows business entities to provide expanded financial information frequently and instantaneously to interested parties. Furthermore, companies that use native-XBRL database technology5 internally as their primary information storage platform can fur- ther speed up the process of reporting. Users of such financial data (for example, investors and analysts) can readily import XBRL documents into internal databases and analysis tools to greatly facilitate their decision-making processes.

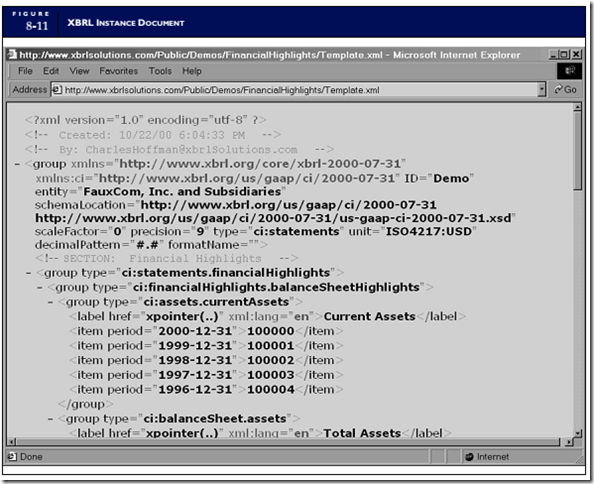

From this new database structure, computer programs that recognize and interpret the tags associated with the data attributes can generate XBRL instance documents (the actual financial reports). Figure 8-11 presents an example of an instance document.6

The XBRL instance document can now be published and made available to users. The document can be placed on an intranet server for internal use; it can be placed on a private extranet for limited dissemination to customers or trading partners; or it can be placed on the Internet for public dissemination. In its current state, the instance document is computer-readable for analysis and processing. To make it more human-readable, HTML layout rules can be provided in a separate style sheet that Web browsers use to present the XBRL information in a visually appealing manner.

THE CURRENT STATE OF XBRL REPORTING

All members of the financial-reporting community should be aware of XBRL as it is an important information exchange technology. In the near future, XBRL will likely be the primary vehicle for delivering business reports to investors and regulators. Recent progress toward that end has been substantial both in the United States and internationally. Some of these developments are summarized here:

• Since October 2005, U.S. banking regulators have required quarterly ‘‘Call Reports’’ to be filed in XBRL. This requirement impacts more than 8,000 banks.

• In April 2005, the SEC began a voluntary financial reporting program that allows registrants to supplement their required filings with exhibits using XBRL.

• In September 2006, the SEC announced its new electronic reporting system to receive XBRL filings.

The new system is called IDEA, short for Interactive Data Electronic Application.

• In May 2008, the SEC issued rules requiring large publicly held companies to adopt XBRL by December 15 to meet financial reporting requirements.

• Comparable developments to encourage or require XBRL have taken place internationally. Since early 2003, the Tokyo Stock Exchange has accepted XBRL information. In 2007, the Canadian Securities

Administrators (CSA) established a voluntary program to help the Canadian marketplace gain practical knowledge in preparing, filing, and using XBRL information. Regulators in China, Spain, The Netherlands, and the United Kingdom are requiring certain companies to use XBRL.

In addition, the use of XBRL will facilitate fulfillment of legal requirements stipulated in the Sarbanes-Oxley Act, which was passed in response to widespread concern and skepticism about financial-reporting standards. In particular, XBRL can play a role in facilitating earlier reporting of financial statements required under SOX legislation.

Comments

Post a Comment