Financial Reporting and Management Reporting Systems:The Financial Reporting System

The Financial Reporting System

The law dictates management’s responsibility for providing stewardship information to external parties. This reporting obligation is met via the FRS. Much of the information provided takes the form of standard financial statements, tax returns, and documents required by regulatory agencies such as the Securities and Exchange Commission (SEC).

The primary recipients of financial statement information are external users, such as stockholders, creditors, and government agencies. Generally speaking, outside users of information are interested in the performance of the organization as a whole. Therefore, they require information that allows them to observe trends in performance over time and to make comparisons between different organizations. Given the nature of these needs, financial reporting information must be prepared and presented by all organizations in a manner that is generally accepted and understood by external users.

SOPHISTICATED USERS WITH HOMOGENEOUS INFORMATION NEEDS

Because the community of external users is vast and their individual information needs may vary, financial statements are targeted at a general audience. They are prepared on the proposition that the audience comprises sophisticated users with relatively homogeneous information needs. In other words, it is assumed that users of financial reports understand the conventions and accounting principles that are applied and that the statements have information content that is useful.

FINANCIAL REPORTING PROCEDURES

Financial reporting is the final step in the overall accounting process that begins in the transaction cycles. Figure 8-4 presents the FRS in relation to the other information subsystems. The steps illustrated and numbered in the figure are discussed briefly in the following section.

The process begins with a clean slate at the start of a new fiscal year. Only the balance sheet (permanent) accounts are carried forward from the previous year. From this point, the following steps occur:

1. Capture the transaction. Within each transaction cycle, transactions are recorded in the appropriate transaction file.

2. Record in special journal. Each transaction is entered into the journal. Recall that frequently occur- ring classes of transactions, such as sales, are captured in special journals. Those that occur infrequently are recorded in the general journal or directly on a journal voucher.

3. Post to subsidiary ledger. The details of each transaction are posted to the affected subsidiary accounts.

4. Post to general ledger. Periodically, journal vouchers, summarizing the entries made to the special journals and subsidiary ledgers, are prepared and posted to the GL accounts. The frequency of updates to the GL will be determined by the degree of system integration.

5. Prepare the unadjusted trial balance. At the end of the accounting period, the ending balance of each account in the GL is placed in a worksheet and evaluated in total for debit–credit equality.

6. Make adjusting entries. Adjusting entries are made to the worksheet to correct errors and to reflect unrecorded transactions during the period, such as depreciation.

7. Journalize and post adjusting entries. Journal vouchers for the adjusting entries are prepared and posted to the appropriate accounts in the GL.

8. Prepare the adjusted trial balance. From the adjusted balances, a trial balance is prepared that contains all the entries that should be reflected in the financial statements.

9. Prepare the financial statements. The balance sheet, income statement, and statement of cash flows are prepared using the adjusted trial balance.

10. Journalize and post the closing entries. Journal vouchers are prepared for entries that close out the income statement (temporary) accounts and transfer the income or loss to retained earnings. Finally, these entries are posted to the GL.

11. Prepare the post-closing trial balance. A trial balance worksheet containing only the balance sheet accounts may now be prepared to indicate the balances being carried forward to the next accounting period.

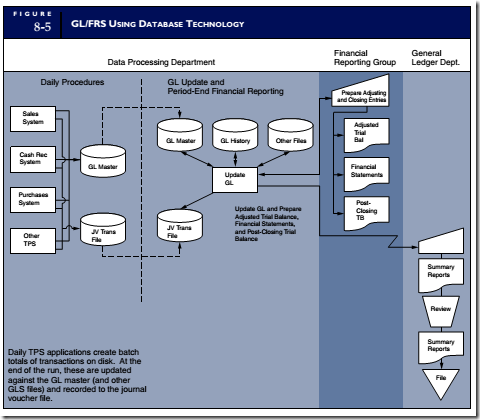

The periodic nature of financial reporting in most organizations establishes it as a batch process, as illustrated in Figure 8-4. This often is the case for larger organizations with multiple streams of revenue and expense transactions that need to be reconciled before being posted to the GL. Many organizations, however, have moved to real-time GL updates and FRSs that produce financial statements on short notice. Figure 8-5 presents an FRS using a combination of batch and real-time computer technology.

Comments

Post a Comment