Problems on Payroll Processing and Fixed Asset Procedures

Problems

1. PAYROLL FRAUD

John Smith worked in the stockyard of a large building supply company. One day he unexpectedly left for California, never to return. His foreman seized the op- portunity to continue to submit time cards for John to the payroll department. Each week, as part of his normal duties, the foreman received the employee paychecks from payroll and distributed them to the workers on his shift. Because John was not present to collect his pay- check, the foreman forged John’s name and cashed it.

Required

Describe two control techniques to prevent or detect this fraud scheme.

2. PAYROLL CONTROLS

Refer to the flowchart for Problem 2.

Required

a. What risks are associated with the payroll procedures depicted in the flowchart?

b. Discuss two control techniques that will reduce or eliminate the risks.

3. PAYROLL CONTROLS

Sherman Company employs 400 production, maintenance, and janitorial workers in eight separate departments. In addition to supervising operations, the supervisors of the departments are responsible for recruiting, hiring, and firing workers within their areas of responsibility. The organization attracts casual labor and experiences a 20 to 30 percent turnover rate in employees per year.

Employees clock on and off the job each day to re- cord their attendance on time cards. Each department has its own clock machine located in an unattended room away from the main production area. Each week, the supervisors gather the time cards, review them for accuracy, and sign and submit them to the payroll

department for processing. In addition, the supervisors submit personnel action forms to reflect newly hired and terminated employees. From these documents, the payroll clerk prepares payroll checks and updates the employee records. The supervisor of the payroll department signs the paychecks and sends them to the department supervisors for distribution to the employees. A payroll register is sent to accounts payable for approval. Based on this approval, the cash disbursements clerk transfers funds into a payroll clearing account.

Required

Discuss the risks for payroll fraud in the Sherman Company payroll system. What controls would you implement to reduce the risks? Use the SAS 78/COSO standard of control activities to organize your response.

4. INTERNAL CONTROL

Discuss any control weaknesses found in the flowchart for Problem 4. Recommend any necessary changes.

5. HUMAN RESOURCE DATA MANAGEMENT

In a payroll system with real-time processing of human resource management data, control issues become very important. List some items in this system that could be very sensitive or controversial. Also describe what types of data must be carefully guarded to ensure that they are not altered. Discuss some control procedures that might be put into place to guard against unwanted changes to employees’ records.

6. PAYROLL FLOWCHART ANALYSIS

Discuss the risks depicted by the payroll system flow- chart for Problem 6. Describe the internal control improvements to the system that are needed to reduce these risks.

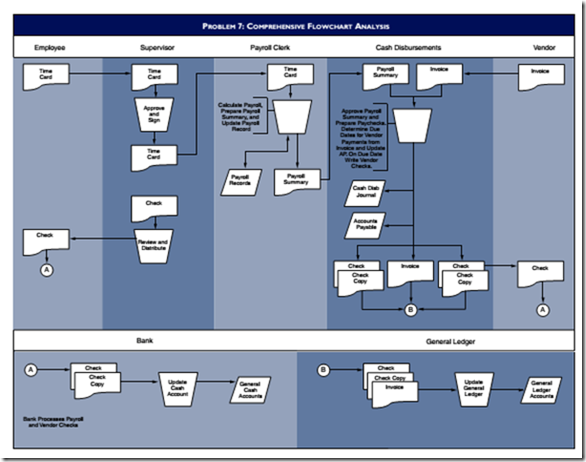

7. COMPREHENSIVE FLOWCHART ANALYSIS

Discuss the internal control weaknesses in the expenditure cycle flowchart for Problem 7. Structure your answer in terms of the control activities within the SAS 78/COSO control model.

8. FIXED ASSET SYSTEM

The fixed asset acquisition procedures for Turner Broth- ers, Inc., are as follows:

Supervisors in the user departments determine their fixed asset needs and submit bids or orders directly to contractors, vendors, or suppliers. In the case of competitive bidding, the user makes the final selection of the vendor and negotiates the prices paid. The assets are delivered directly to the user areas. The users inspect and formally receive the assets. They submit the invoice to the cash disbursements department for payment.

Required

Discuss the risks associated with this process. Describe the controls that should be implemented to reduce these risks.

9. FIXED ASSET SYSTEM

Holder Co. maintains a large fleet of automobiles, trucks, and vans for their service and sales force. Super- visors in the various departments maintain the fixed asset records for these vehicles, including routine maintenance, repairs, and mileage information. This information is periodically submitted to the fixed asset department, which uses it to calculate depreciation on the vehicle. To ensure a reliable fleet, the company dis- poses of vehicles when they accumulate 80,000 miles

of service. Depending on usage, some vehicles reach this point sooner than others. When a vehicle reaches 80,000 miles, the supervisor is authorized to use it in trade for a new replacement vehicle or to sell it privately. Employees of the company are given the first option to bid on the retired vehicles. Upon disposal of the vehicle, the supervisor submits a disposal report to the fixed asset department, which writes off the asset.

Required

Discuss the potential for abuse and fraud in this system. Describe the controls that should be implemented to reduce the risks.

10. FIXED ASSET FLOWCHART ANALYSIS

Discuss the risks depicted by the fixed asset system flow- chart for Problem 10. Describe the internal control improvements to the system that are needed to reduce these risks.

11. FIXED ASSET SYSTEM

The treatment of fixed asset accounting also includes accounting for mineral reserves, such as oil and gas, coal, gold, diamonds, and silver. These costs must be capitalized and depleted over the estimated useful life of the asset. The depletion method used is the units of production method. An example of a source document for an oil and gas exploration firm is presented in the figure for Problem 11. The time to drill a well from start to completion may vary from 3 to 18 months, depend- ing on the location. Further, the costs to drill two or more wells may be difficult to separate. For example, the second well may be easier to drill because more is known about the conditions of the field or reservoir, and the second well may be drilled to help extract the same reserves more quickly or efficiently.

Solving this problem may require additional research beyond the readings in the chapter.

Required

a. In Figure 6-11, the source documents for the fixed asset accounting system come from the receiving department and the accounts payable department. For an oil and gas firm, from where would you expect the source documents come?

b. Assume that a second well is drilled to help extract the reserves from the field. How would you allocate the drilling costs?

c. The number of reserves to be extracted is an estimate. These estimates are constantly being revised. How does this affect the fixed asset department’s job? In what way, if at all, does Figure 6-13 need to be altered to reflect these adjustments?

d. How does the auditor verify the numbers that the fixed asset department calculates at the end of the period?

12. PAYROLL PROCEDURES

When employees arrive for work at Harlan Manufacturing, they punch their time cards at a time clock in an unsupervised area. Mary, the time-keeping clerk, tries to keep track of the employees but is often distracted by other things. Every Friday, she submits the time cards to Marsha, the payroll clerk.

Marsha copies all time cards and files the copies in

the employees’ folders. She uses employee wage records and tax tables to calculate the net pay for each employee. She sends a copy of the payroll register to the accounts payable department and files a copy in the payroll department. She updates the employee records with the earnings and prepares the payroll summary and sends it to the cash disbursements department along with the paychecks.

After receiving the payroll summary, John, an accounts payable clerk, authorizes the cash disbursements department to prepare paychecks. John then updates the cash disbursements journal. The treasurer signs the paychecks and gives them to the supervisors, who distribute them to the employees. Finally, both the accounts payable and cash disbursements departments send a summary of transactions to the general ledger department.

Required

a. Analyze the internal control weaknesses in the sys- tem. Model your response according to the six categories of physical control activities specified in the SAS 78/COSO control model.

b. Make recommendations for improving the system.

13. FIXED ASSET SYSTEM

Fittipaldi Company recently purchased a patent for a radar detection device for $8 million. This radar detection device has been proven to detect three times better than any existing radar detector on the market. Fittipaldi expects four years to pass before any competitor can devise a technology to beat its device.

Required

a. Why does the $8 million represent an asset? Should the fixed asset department be responsible for its accounting?

b. Where would the source documents come from?

c. What happens if a competitor comes out with a new model in two years rather than four?

d. How does the auditor verify the numbers that the fixed asset department calculated at the end of the period? Is it the auditor’s responsibility to be aware of external regulatory conditions that might affect the value of the patent? For example, what if seven more states prohibit the use of radar detectors?

Comments

Post a Comment