Problems on Purchases and Cash Disbursements Procedures

Problems

1. UNRECORDED LIABILITIES

You are auditing the financial statements of a New York City company that buys a product from a manufacturer in Los Angeles. The buyer closes its books on June 30. Assume the following details:

Terms of trade FOB shipping point

June 10, buyer sends purchase order to seller

June 15, seller ships goods

July 5, buyer receives goods

July 10, buyer receives seller’s invoice

Required

a. Could this transaction have resulted in an unrecorded liability in the buyer’s financial statements?

b. If yes, what documents provide audit trail evidence of the liability?

c. On what date did the buyer realize the liability?

d. On what date did the buyer recognize the liability?

New assumption:

Terms of trade free on board destination

e. Could this transaction have resulted in an unrecorded liability in the buyer’s financial statements?

f. If yes, what documents provide audit trail evidence of the liability?

g. On what date did the buyer realize the liability?

h. On what date did the buyer recognize the liability?

2. INVENTORY ORDERING ALTERNATIVES

Refer to Figure 5-16 in the text, which illustrates three alternative methods of ordering inventory.

Required

a. Distinguish between a purchase requisition and a purchase order.

b. Discuss the primary advantage of alternative two over alternative one. Be specific.

c. Under what circumstances can you envision man- agement using alternative one rather than alterna- tive two?

3. DOCUMENT PREPARATION

Create the appropriate documents (purchase requisition, purchase order, receiving report, inventory record, and disbursement voucher), and prepare any journal entries needed to process the following business events for Jethro’s Boot & Western Wear Manufacturing Company (this is a manual system).

a. On October 28, 2005, the inventory subsidiary ledger for Item 2278, metal pins, indicates that the quantity on hand is 4,000 units (valued at $76), the reorder point is 4,750, and units are on order. The economic order quantity is 6,000 units. The sup- plier is Jed’s Metal Supply Company (vendor num- ber 83682). The customer number is 584446. The current price per unit is $0.02. Inventory records are kept at cost. The goods should be delivered to Inventory Storage Room 2.

b. On November 8, the goods were received (the scales indicated that 4,737 units were received).

c. On November 12, an invoice (number 9886) was received for the above units, which included freight of $6. The terms were 1/10, net 30. Jethro’s likes to keep funds available for use as long as possible without missing any discounts.

4. FLOWCHART ANALYSIS

Examine the diagram for Problem 4 and indicate any incorrect initiation and/or transfer of documentation. What problems could this cause?

5. ACCOUNTING RECORDS AND FILES

Indicate which department—accounts payable, cash dis- bursements, data processing, purchasing, inventory, or receiving—has ownership over the following files and registers:

a. open purchase order file

b. purchase requisition file

c. open purchase requisition file

d. closed purchase requisition file

e. inventory

f. closed purchase order file

g. valid vendor file

h. voucher register

i. open vouchers payable file

j. receiving report file

k. closed voucher file

l. check register (cash disbursements journal)

6. SOURCE DOCUMENTS IDENTIFICATION

Explain, in detail, the process by which the information is obtained and the source of information for each of the fields in the expenditure cycle files. (See Figure 5-15 for a complete listing of files and fields.)

7. DATA PROCESSING

Explain how the processing procedures would differ, if at all, for the transactions listed in Problem 6 if a com- puter-based system with

a. a basic batch-processing system were implemented.

b. a batch-processing system with real-time data input were used.

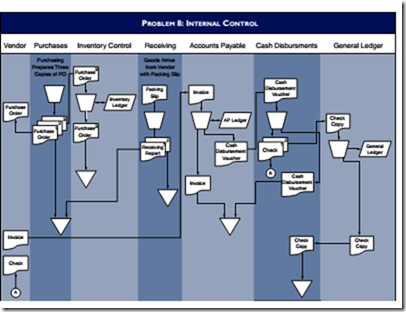

8. INTERNAL CONTROL

Using the flowchart for Problem 8 of a purchases sys- tem, identify six major control weaknesses in the sys- tem. Discuss and classify each weakness in accordance with SAS 78/COSO.

9. PURCHASE DISCOUNTS LOST

Estimate the amount of money accounts payable and cash disbursements departments could save if a basic batch-processing system were implemented. Assume that the clerical workers cost the firm $12 per hour, that 13,000 vouchers are prepared, and that 5,000 checks are written per year. Assume that total cash disbursements to vendors amount to $5 million per year. Because of sloppy bookkeeping, the current system takes advantage of only about 25 percent of the discounts vendors offer for timely payments. The average discount is 2 percent if payment is made within 10 days. Payments are currently made on the 15th day after the invoice is received. Make your own assumptions (and state them) regarding how long specific tasks will take. Also dis- cuss any intangible benefits of the system. (Don’t worry about excessive paper documentation costs.)

10. DATA PROCESSING OUTPUT

Using the information provided in Problem 9, discuss all transaction listings and summary reports that would be necessary for a batch system with real-time input of data.

11. INTERNAL CONTROL

The following is a description of manufacturing company’s purchasing procedures. All computers in the company are networked to a centralized accounting system so that each terminal has full access to a common database.

The inventory control clerk periodically checks inventory levels from a computer terminal to identify items that need to be ordered. Once the clerk feels inventory is too low, he chooses a supplier and creates a purchase order from the terminal by adding a record to the purchase order file. The clerk prints a hard copy of the purchase order and mails it to the vendor. An electronic notification is also sent to accounts payable and receiving, giving the clerks of each department access to the purchase order from their respective terminals.

When the raw materials arrive at the unloading dock, a receiving clerk prints a copy of the purchase order from his terminal and reconciles it to the packing slip. The clerk then creates a receiving report on a computer system. An electronic notification is sent to accounts payable and inventory control, giving the respective clerks access to the receiving report. The inventory control clerk then updates the inventory records.

When the accounts payable clerk receives a hardcopy invoice from the vendor, she reconciles the invoice with the digital purchase order and receiving report and prepares a paper cash disbursements voucher. The cash disbursements voucher and invoice are placed in the open accounts payable file in a filing cabinet until the due date. The clerk also updates the accounts pay- able subsidiary ledger and records the liability amount in the purchase journal from the department computer terminal. The accounts payable clerk periodically reviews the cash disbursement file for items due and, when they are identified, prepares a check for the amount due. Finally, using the department terminal, the clerk removes the liability from the accounts payable subsidiary file and posts the disbursement to the cash account.

Required

a. Create a system flowchart of the system.

b. Analyze the internal control weaknesses in the sys- tem. Model your response according to the six cate- gories of physical control activities specified in SAS 78/COSO.

12. ACCOUNTING DOCUMENTS

Required

Answer the following questions.

a. Which department is responsible for initiating the purchase of materials?

b. What is the name of the document generated by the department identified in (a) above?

c. Typically, multiple copies of a purchase order are prepared. One copy should go to the vendor, and one is retained in the purchasing department. To achieve proper control, which other departments should receive copies of the purchase order?

d. What documents does the accounts payable clerk review before setting up a liability?

e. Which document transfers responsibility for goods sold to a common carrier?

Comments

Post a Comment