The Revenue Cycle:Computer-Based Accounting Systems

Computer-Based Accounting Systems

We can view technological innovation in AIS as a continuum with automation at one end and reengineering at the other. Automation involves using technology to improve the efficiency and effectiveness of a task. Too often, however, the automated system simply replicates the traditional (manual) process that it replaces. Reengineering, on the other hand, involves radically rethinking the business process and the work flow. The objective of reengineering is to improve operational performance and reduce costs by identifying and eliminating non–value-added tasks. This involves replacing traditional procedures with procedures that are innovative and often very different from those that previously existed.

In this section we review automation and reengineering techniques applied to both sales order process- ing and cash receipts systems. We also review the key features of point-of-sale (POS) systems. Next, we examine electronic data interchange (EDI) and the Internet as alternative techniques for reengineering the revenue cycle. Finally, we look at some issues related to PC-based accounting systems.

AUTOMATING SALES ORDER PROCESSING WITH BATCH TECHNOLOGY

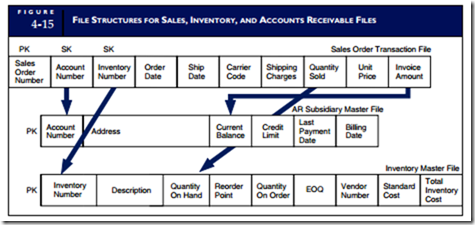

The file structures used to illustrate the following automated system are presented in Figure 4-15. The relationship between key data in the transaction files and master files that it updates is represented with arrows. Notice also that the sales order file has three key fields—SALES ORDER NUMBER, ACCOUNT NUM- BER, and INVENTORY NUMBER. SALES ORDER NUMBER is the primary key (PK) because it is the

only field that uniquely identifies each record in the file. This is the preprinted number on the physical source document that is transcribed during the keystroke operation. In systems that do not use physical source documents, the system automatically assigns this unique number. The PK is critical in preserving the audit trail. It provides the link between digital records stored on a computer disk and the physical source documents.

ACCOUNT NUMBER and INVENTORY NUMBER are both secondary keys (SK) as neither of these keys uniquely identifies sales order records. For instance, there may be more than one sales order for a particular customer. Similarly, the same inventory item type may be sold to more than one customer. Hence, the values for these keys are not unique. Their purpose is to locate the corresponding records in the AR subsidiary and inventory master files.

A simplifying assumption in this hypothetical system is that each sales order record is for a single item of inventory. This one-to-one relationship is unrealistic because in reality one sales order could include many different inventory items. In Chapter 9, we will examine more complex file structures that permit the representation of one-to-many (1:M) and many-to-many (M:M) relationships that are frequently found in business transactions. At this point, however, avoiding this complicating factor will facilitate under- standing of both automated and reengineered systems.

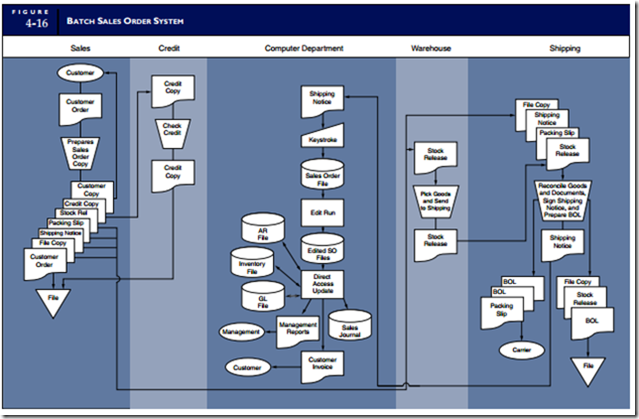

Figure 4-16 illustrates an automated sales order system that employs batch processing.1 The greatest impact from this low-end technology is seen in billing, inventory control, accounts receivable, and gen- eral ledger. These previously manual bookkeeping tasks have been automated. The two principal advantages of this are cost savings and error reduction. By automating accounting tasks, a firm can reduce its clerical staff and its exposure to many forms of errors. Other clerical and operational tasks including sales order taking, credit checking, warehousing, and shipping are performed manually in this system. The tasks presented in Figure 4-16 are described in the following sections.

Sales Department

The sales process begins with a customer contacting the sales department and placing an order. The sales clerk records the essential details and prepares multiple copies of a sales order, which are held pending credit approval.

Credit Department Approval

When credit is approved, the sales department releases copies of the sales order to the billing, warehouse, and shipping departments. The customer order and credit approval are then placed in the open order file.

Warehouse Procedures

Next the warehouse clerk receives the stock release copy of the sales order and uses this to pick the goods. The inventory and stock release are then sent to the shipping department.

The Shipping Department

The shipping clerk reconciles the products received from the warehouse with the shipping notice. Assuming no discrepancies exist, a bill of lading is prepared, and the products are packaged and shipped via common carrier to the customer. The clerk then sends the shipping notice to the computer department.

KEYSTROKE

The automated element of the system begins with the arrival of batches of shipping notices from the shipping department. These documents are verified copies of the sales orders that contain information about the customer and the items shipped. The keystroke clerk converts the hard-copy shipping notices to digital form to produce a transaction file of sales orders. This is a continuous process. Several times throughout the day, the keystroke clerk transcribes batches of shipping notices. The resulting transaction file will thus contain many separate batches of records. For each batch stored on the file, batch control totals are automatically calculated.2

EDIT RUN

Periodically, the sales order system is executed. Depending on transaction volume and the need for current information, this could be a single end-of-day task or performed several times per day. The system is com- posed of a series of program runs. The edit program first validates all transaction records in the batch by performing clerical and logical tests on the data. Typical tests include field checks, limit tests, range tests, and price-times-quantity extensions.3 Recall from Chapter 2 that detected errors are removed from the batch and copied to a separate error file (not shown in Figure 4-16), which are later corrected and resubmitted for processing with the next day’s business. The edit program recalculates the batch control totals to reflect any changes due to the removal of error records. The edited sales order file is then passed to the file update run.

UPDATE PROCEDURES

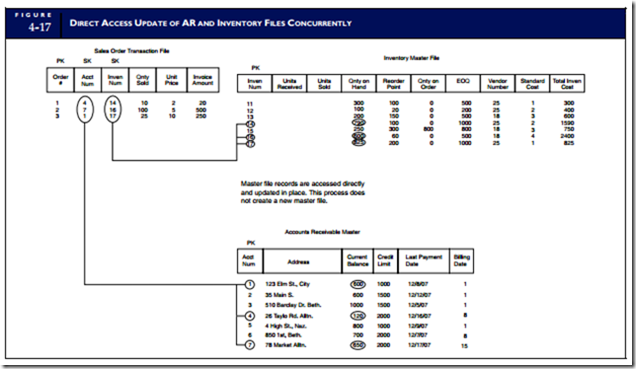

Figure 4-17 illustrates the direct access update process using sample data. Starting at the top of the edited sales order file, the update program posts the first transaction to the corresponding inventory and AR subsidiary records using the secondary keys (INVENTORY NUMBER and ACCOUNT NUMBER) to locate the records directly. This transaction is then recorded in the journal, and the program moves to the next transaction record and repeats the process. This continues until all records in the transaction file have been posted. The general ledger accounts are typically updated after each batch. When the program reaches the end of the transaction file, it terminates.

This system generates a number of management reports, including sales summaries, inventory status reports, transaction listings, journal voucher listings, and budget and performance reports. Quality management reports play a key role in helping management monitor operations to ensure that controls are in place and functioning properly. In Chapter 8, we examine management information needs and management reporting techniques in detail.

REENGINEERING SALES ORDER PROCESSING WITH REAL-TIME TECHNOLOGY

Figure 4-18 illustrates a real-time sales order system. Interactive computer terminals replace many of the manual procedures and physical documents of the previous system. This interactive system provides real- time input and output with batch updating of only some master files.

TRANSACTION PROCESSING PROCEDURES

Sales Procedures

Under real-time processing, sales clerks receiving orders from customers process each transaction separately as it is received. Using a computer terminal connected to a sales order system, the clerk performs the following tasks in real-time mode:

1. The system accesses the inventory subsidiary file and checks the availability of the inventory. It then performs a credit check by retrieving the customer credit data in the customer’s (AR) file. This file contains information such as the customer’s credit limit, current balance, date of last payment, and current credit status. Based on programmed criteria, the customer’s request for credit is approved or denied.

2. If credit is approved, the system updates the customer’s current balance to reflect the sale and reduces inventory by the quantities of items sold to present an accurate and current picture of inventory on hand and available for sale.

3. The system automatically transmits a digital stock release document to the warehouse, a digital ship- ping notice to the shipping department, and records the sale in the open sales order file. The structure of this file includes a CLOSED field that contains either the value N or Y to indicate the status of the order. Closed records (those containing the value Y) have been shipped, so the customer can now be billed. This field is used later to identify closed records to the batch procedure. The default value in this field when the record is created is N. It is changed to Y when the goods are shipped to the

Warehouse Procedures

The warehouse clerk’s terminal immediately produces a hard-copy printout of the electronically transmit- ted stock release document. The clerk then picks the goods and sends them, along with a copy of the stock release document, to the shipping department.

Shipping Department

A shipping clerk reconciles the goods, the stock release document, and the hard-copy packing slip produced on the terminal. The clerk then selects a carrier and prepares the goods for shipment. From the terminal, the clerk transmits a shipping notice containing shipping date and freight charges. The system updates the open sales order record in real time and places a Y value in the CLOSED field, thus closing the sales order.

GENERAL LEDGER UPDATE PROCEDURES

At the end of the day, the batch update program searches the open sales order file for records marked closed and updates the following general ledger accounts: Inventory—Control, Sales, AR—Control, and Cost of Goods Sold. The inventory subsidiary and AR subsidiary records were updated previously during the real-time procedures. Recall from Chapter 2 that batch updating of general ledger records is done to achieve operational efficiency in high-volume transaction processing systems. An alternative approach is to update the general ledger accounts in real time, if doing so poses no significant operational delays. Finally, the batch program prepares and mails customer bills and transfers the closed sales records to the closed sales order file (sales journal).

ADVANTAGES OF REAL-TIME PROCESSING

Reengineering the sales order processes to include real-time technology can significantly reduce operating costs while increasing revenues. The following advantages make this approach an attractive option for many organizations:

1. Real-time processing greatly shortens the cash cycle of the firm. Lags inherent in batch systems can cause delays of several days between taking an order and billing the customer. A real-time system with remote terminals reduces or eliminates these lags. An order received in the morning may be shipped by early afternoon, thus permitting same-day billing of the customer.

2. Real-time processing can give the firm a competitive advantage in the marketplace. By maintaining current inventory information, sales staff can determine immediately whether the inventories are on hand. This enhances the firm’s ability to maximize customer satisfaction, which translates into increased sales. In contrast, batch systems do not provide salespeople with current information. As a result, a portion of the order must sometimes be back-ordered, causing uncertainty for the customer.

3. Manual procedures tend to produce clerical errors, such as incorrect account numbers, invalid inven- tory numbers, and price–quantity extension miscalculations. These errors may go undetected in batch systems until the source documents reach data processing, by which time the damage may have al- ready been done. For example, the firm may find that it has shipped goods to the wrong address, shipped the wrong goods, or promised goods to a customer at the wrong price. Real-time editing permits the identification of many kinds of errors as they occur and greatly improves the efficiency and the effectiveness of operations.

4. Finally, real-time processing reduces the amount of paper documents in a system. Hard-copy documents are expensive to produce and clutter the system. The permanent storage of these documents can become a financial and operational burden. Documents in digital form are efficient, effective, and adequate for audit trail purposes.

AUTOMATED CASH RECEIPTS PROCEDURES

Cash receipts procedures are natural batch systems. Unlike sales transactions, which tend to occur continuously throughout the day, cash receipts are discrete events. Checks and remittance advices arrive from the postal service in batches. Likewise, the deposit of cash receipts in the bank usually happens as a single event at the end of the business day. The cash receipts system in Figure 4-19 uses technology that auto- mates manual procedures. The following discussion outlines the main points of this system.

Mail Room

The mail room clerk separates the checks and remittance advices and prepares a remittance list. These checks and a copy of the remittance list are sent to the cash receipts department. The remittance advices and a copy of the remittance list are sent to the AR department.

Cash Receipts Department

The cash receipts clerk reconciles the checks and the remittance list and prepares the deposit slips. Via terminal, the clerk creates a journal voucher record of total cash received. The clerk files the remittance list and one copy of the deposit slip. At the end of the day, the clerk deposits the cash in the bank.

Accounts Receivable Department

The AR clerk receives and reconciles the remittance advices and remittance list. Via terminal, the clerk creates the cash receipts transaction file based on the individual remittance advices. The clerk then files the remittance advices and the remittance list.

Data Processing Department

At the end of the day, the batch program reconciles the journal voucher with the transaction file of cash receipts and updates the AR subsidiary and the general ledger control accounts (AR—Control and Cash). This process employs the direct access method described earlier. Finally, the system produces a transaction listing that the AR clerk will reconcile against the remittance list.

REENGINEERED CASH RECEIPTS PROCEDURES

The task of opening envelopes and comparing remittance advices against customer checks is labor-intensive, costly, and creates a control risk. Some organizations have reengineered their mail room procedures to effectively reduce the risk and the cost.

The mail room clerk places batches of unopened envelopes into a machine that automatically opens them and separates their contents into remittance advices and checks. Because the remittance advice contains the address of the payee, the customer will need to place it at the front of the envelope so it can be displayed through the window. When the envelope is opened, the machine knows that the first document in the envelope is the remittance advice. The second is, therefore, the check. The process is performed internally and, once the envelopes are opened, mail room staff cannot access their contents.

The system uses special transaction validation software that employs artificial intelligence capable of reading handwriting. The system scans the remittance advices and the checks to verify that the dollar amounts on each are equal and that the checks are signed. Any items that are inconsistent or that the validation system cannot interpret are rejected and processed separately by hand. The system prepares a computer-readable file of cash receipts, which is then posted to the appropriate customer and general ledger accounts. Batches of checks are sent to the cash receipts department for deposit in the bank. Transaction listings are sent to management in the AR, cash receipts, and general ledger departments for review and audit purposes.

Organizations with sufficient transaction volume to justify the investment in hardware and software have the advantages of improved control and reduced operating costs. The system works best when a high degree of consistency between remittance advices and customer checks exists. Partial payments, multiple payments (a single check covering multiple invoices), and clerical errors on customer checks complicate the process and may cause rejections that require separate processing.

POINT-OF-SALE (POS) SYSTEMS

The revenue cycle systems that we have examined so far are used by organizations that extend credit to their customers. Obviously, this assumption is not valid for all types of business enterprises. For example, grocery stores do not usually function in this way. Such businesses exchange goods directly for cash in a transaction that is consummated at the point of sale.

POS systems like the one shown in Figure 4-20 are used extensively in grocery stores, department stores, and other types of retail organizations. In this example, only cash, checks, and bank credit card sales are valid. The organization maintains no customer accounts receivable. Inventory is kept on the store’s shelves, not in a separate warehouse. The customers personally pick the items they wish to buy and carry them to the checkout location, where the transaction begins.

DAILY PROCEDURES

First, the checkout clerk scans the universal product code (UPC) label on the items being purchased with a laser light scanner. The scanner, which is the primary input device of the POS system, may be handheld or mounted on the checkout table. The POS system is connected online to the inventory file from which it retrieves product price data and displays this on the clerk’s terminal. The inventory quantity on hand is reduced in real time to reflect the items sold. As items fall to minimum levels, they are automatically reordered.

When all the UPCs are scanned, the system automatically calculates taxes, discounts, and the total for the transaction. In the case of credit card transactions, the sales clerk obtains transaction approval from the credit card issuer via an online connection. When the approval is returned, the clerk prepares a credit card voucher for the amount of the sale, which the customer signs. The clerk gives the customer one copy of the voucher and secures a second copy in the cash drawer of the register. For cash sales, the customer renders cash for the full amount of the sale, which the clerk secures in the cash drawer.

The clerk enters the transaction into the POS system via the register’s keypad, and a record of the sale is added to the sales journal in real time. The record contains the following key data: date, time, terminal number, total amount of sale, cash or credit card sale, cost of items sold, sales tax, and discounts taken. The sale is also recorded on a two-part paper tape. One copy is given to the customer as a receipt; the other is secured internally within the register and the clerk cannot access it. This internal tape is later used to close out the register when the clerk’s shift is over.

At the end of the clerk’s shift, a supervisor unlocks the register and retrieves the internal tape. The cash drawer is removed and replaced with a new cash drawer containing a known amount of start-up cash (float) for the next clerk. The supervisor and the clerk whose shift has ended take the cash drawer to the cash room (treasury), where the contents are reconciled against the internal tape. The cash drawer should contain cash and credit card vouchers equal to the amount recorded on the tape.

Often, small discrepancies will exist because of errors in making change for customers. Organizational policy will specify how cash discrepancies are handled. Some organizations require sales clerks to cover all cash shortages via payroll deductions. Other organizations establish a materiality threshold. Cash shortages within the threshold are recorded but not deducted from the employee’s pay. Excess shortages, however, should be reviewed for possible disciplinary action.

When the contents of the cash drawer have been reconciled, the cash receipts clerk prepares a cash reconciliation form and gives one copy to the sales clerk as a receipt for cash remitted and records cash received and cash short/over in the cash receipts journal. The clerk files the credit card vouchers and secures the cash in the safe for deposit in the bank at the end of the day.

END-OF-DAY PROCEDURES

At the end of the day, the cash receipts clerk prepares a three-part deposit slip for the total amount of the cash received. One copy is filed and the other two accompany the cash to the bank. Because cash is involved, armed guards are often used to escort the funds to the bank repository.

Finally, a batch program summarizes the sales and cash receipts journals, prepares a journal voucher, and posts to the general ledger accounts as follows:

The accounting entry in the table may vary among businesses. Some companies will treat credit card sales as cash. Others will maintain an AR until the credit card issuer transfers the funds into their account.

REENGINEERING USING EDI

Doing Business via EDI

Many organizations have reengineered their sales order process through electronic data interchange (EDI). EDI technology was devised to expedite routine transactions between manufacturers and wholesalers and between wholesalers and retailers. The customer’s computer is connected directly to the sell- er’s computer via telephone lines. When the customer’s computer detects the need to order inventory, it automatically transmits an order to the seller. The seller’s system receives the order and processes it automatically. This system requires little or no human involvement.

EDI is more than just a technology. It represents a business arrangement between the buyer and seller in which they agree, in advance, to the terms of their relationship. For example, they agree to the selling price, the quantities to be sold, guaranteed delivery times, payment terms, and methods of handling dis- putes. These terms are specified in a trading partner agreement and are legally binding. Once the agree- ment is in place, no individual in either the buying or selling company actually authorizes or approves a particular EDI transaction. In its purest form, the exchange is completely automated.

EDI poses unique control problems for an organization. One problem is ensuring that, in the absence of explicit authorization, only valid transactions are processed. Another risk is that a trading partner, or someone masquerading as a trading partner, will access the firm’s accounting records in a way that is unauthorized by the trading partner agreement. Chapter 12 presents the key features of EDI and its implications for business. EDI control issues are discussed in Chapter 16.

REENGINEERING USING THE INTERNET

Doing Business on the Internet

Thousands of organizations worldwide are establishing home pages on the Internet to promote their products and solicit sales. By entering the seller’s home page address into the Internet communication pro- gram from a PC, a potential customer can access the seller’s product list, scan the product line, and place an order. Typically, Internet sales are credit card transactions. The customer’s order and credit card information are attached to the seller’s e-mail file.

An employee reviews the order, verifies credit, and enters the transaction into the seller’s system for processing in the normal way. Because of the need to review the e-mail file before processing, the turn- around time for processing Internet sales is sometimes longer than for telephone orders. Research is currently under way to develop intelligent agents (software programs) that review and validate Internet orders automatically as they are received.

Unlike EDI, which is an exclusive business arrangement between trading partners, the Internet connects an organization to the thousands of potential business partners with whom it has no formal agreement. In addition to unprecedented business opportunities, risks for both the seller and the buyer accompany this technology. Connecting to the Internet exposes the organization to threats from computer hackers, viruses, and transaction fraud. Many organizations take these threats seriously and implement controls including password techniques, message encryption, and firewalls to minimize their risk. The technology of networks is discussed in the appendix to Chapter 12. In Chapter 16, we examine techniques for controlling these technologies.

CONTROL CONSIDERATIONS FOR COMPUTER-BASED SYSTEMS

The remainder of this section looks at the relationship between internal controls under alternative processing technologies. The purpose of this discussion is to identify the nature of new exposures and gain some insight into their ramifications. Solutions to many of these problems are beyond the scope of discussion at this point. Chapters 15, 16, and 17 present these general control issues as well as management and auditor responsibilities under Sarbanes-Oxley legislation.

Authorization

Transaction authorization in real-time processing systems is an automated task. Management and accountants should be concerned about the correctness of the computer-programmed decision rules and the quality of the data used in this decision.

In POS systems, the authorization process involves validating credit card charges and establishing that the customer is the valid user of the card. After receiving online approval from the credit card company, the clerk should match the customer’s signature on the sales voucher with the one on the credit card.

Segregation of Duties

Tasks that would need to be segregated in manual systems are often consolidated within computer programs. For example, a computer application may perform such seemingly incompatible tasks as inventory control, AR updating, billing, and general ledger posting. In such situations, management and auditor concerns are focused on the integrity of the computer programs that perform these tasks. They should seek answers to such questions as: Is the logic of the computer program correct? Has anyone tampered with the application since it was last tested? Have changes been made to the program that could have caused an undisclosed error?

Answers to the questions lie, in part, in the quality of the general controls over segregation of duties related to the design, maintenance, and operation of computer programs. Programmers who write the original computer programs should not also be responsible for making program changes. Both of these functions should also be separate from the daily task of operating the system.

Supervision

In an earlier discussion, we examined the importance of supervision over cash-handling procedures in the mail room. The individual who opens the mail has access both to cash (the asset) and to the remittance advice (the record of the transaction). A dishonest employee has an opportunity to steal the check and destroy the remittance advice. This risk exists in both manual systems and computer-based systems where manual mail room procedures are in place.

In a POS system, where both inventory and cash are at risk, supervision is particularly important. Customers have direct access to inventory in the POS system, and the crime of shoplifting is of great concern to management. Surveillance cameras and shop floor security personnel can reduce the risk. These techniques are also used to observe sales clerks handling cash receipts from customers. In addition, the cash register’s internal tape is a form of supervision. The tape contains a record of all sales transactions processed at the register. Only the clerk’s supervisor should have access to the tape, which is used at the end of the shift to balance the cash drawer.

Access Control

In computerized systems, digital accounting records are vulnerable to unauthorized and undetected access. This may take the form of an attempt at fraud, an act of malice by a disgruntled employee, or an honest accident. Additional exposures exist in real-time systems, which often maintain accounting records entirely in digital form. Without physical source documents for backup, the destruction of com- puter files can leave a firm with inadequate accounting records. To preserve the integrity of accounting records, Sarbanes-Oxley legislation requires organization management to implement controls that restrict unauthorized access. Also at risk are the computer programs that make programmed decisions, manipulate accounting records, and permit access to assets. In the absence of proper access controls over pro- grams, a firm can suffer devastating losses from fraud and errors. Thus, current laws require management to implement such controls.

Because POS systems involve cash transactions, the organization must restrict access to cash assets.

One method is to assign each sales clerk to a separate cash register for an entire shift. When the clerk leaves the register to take a break, the cash drawer should be locked to prevent unauthorized access. This can be accomplished with a physical lock and key or by password. At the end of the clerk’s shift, he or she should remove the cash drawer and immediately deposit the funds in the cash room. When clerks need to share registers, responsibility for asset custody is split among them and accountability is reduced.

Inventory in the POS system must also be protected from unauthorized access and theft. Both physical restraints and electronic devices are used to achieve this. For example, steel cables are often used in clothing stores to secure expensive leather coats to the clothing rack. Locked showcases are used to display jewelry and costly electronic equipment. Magnetic tags are attached to merchandise, which will sound an alarm when removed from the store.

Accounting Records

DIGITAL JOURNALS AND LEDGERS. Digital journals and master files are the basis for financial reporting and many internal decisions. Accountants should be skeptical about accepting, on face value, the accuracy of computer-produced hard-copy printouts of digital records. The reliability of hard-copy documents for auditing rests directly on the quality of the controls that protect them from unauthorized manipulation. The accountant should, therefore, be concerned about the quality of controls over the pro- grams that update, manipulate, and produce reports from these files.

FILE BACKUP. The physical loss, destruction, or corruption of digital accounting records is a serious concern. The data processing department should perform separate file-backup procedures (discussed in Chapter 2). Typically these are behind-the-scenes activities that may not appear on the system flowchart. The accountant should verify that such procedures are, in fact, performed for all subsidiary and general ledger files. Although backup requires significant time and computer resources, it is essential in pre- serving the integrity of accounting records.

Independent Verification

The consolidation of many accounting tasks under one computer program removes some of the traditional independent verification control from the system. Independent verification is restored somewhat by performing batch control balancing after each run and by producing management reports and summaries for end users to review.

Comments

Post a Comment