Introduction to transaction processing:Data Coding Schemes

Data Coding Schemes

Within the context of transaction processing, data coding involves creating simple numeric or alpha- betic codes to represent complex economic phenomena that facilitate efficient data processing. In Figure 2-28, for example, we saw how the secondary keys of transaction file records are linked to the primary keys of master file records. The secondary and primary keys in the example are instances of data coding. In this section we explore several data coding schemes and examples of their applica- tion in AIS. To emphasize the importance of data codes, we first consider a hypothetical system that does not use them.

A SYSTEM WITHOUT CODES

Firms process large volumes of transactions that are similar in their basic attributes. For instance, a firm’s AR file may contain accounts for several different customers with the same name and similar addresses. To process transactions accurately against the correct accounts, the firm must be able to distinguish one John Smith from another. This task becomes particularly difficult as the number of similar attributes and items in the class increase.

Consider the most elemental item that a machine shop wholesaler firm might carry in its inventory—a machine nut. Assume that the total inventory of nuts has only three distinguishing attributes: size, mate- rial, and thread type. As a result, this entire class of inventory must be distinguished on the basis of these three features, as follows:

1. The size attribute ranges from 1=4 inch to 13=4 inches in diameter in increments of 1=64 of an inch, giving 96 nut sizes.

2. For each size subclass, four materials are available: brass, copper, mild steel, and case-hardened steel.

3. Each of these size and material subclasses come in three different threads: fine, standard, and coarse.

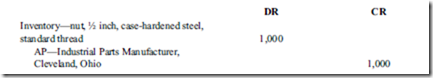

Under these assumptions, this class of inventory could contain 1,152 separate items (96 x 4 x 3). The identification of a single item in this class thus requires a description featuring these distinguishing attributes. To illustrate, consider the following journal entry to record the receipt of $1,000 worth of half-inch, case- hardened steel nuts with standard threads supplied by Industrial Parts Manufacturer of Cleveland, Ohio.

This uncoded entry takes a great deal of recording space, is time-consuming to record, and is obvi- ously prone to many types of errors. The negative effects of this approach may be seen in many parts of the organization:

1. Sales staff. Properly identifying the items sold requires the transcription of large amounts of detail onto source documents. Apart from the time and effort involved, this tends to promote clerical errors and incorrect shipments.

2. Warehouse personnel. Locating and picking goods for shipment are impeded and shipping errors will likely result.

3. Accounting personnel. Postings to ledger accounts will require searching through the subsidiary files using lengthy descriptions as the key. This will be painfully slow, and postings to the wrong accounts will be common.

A SYSTEM WITH CODES

These problems are solved, or at least greatly reduced, by using codes to represent each item in the inventory and supplier accounts. Let’s assume the inventory item in our previous example had been assigned the numeric code 896, and the supplier in the AP account is given the code number 321. The coded version of the previous journal entry can now be greatly simplified:

This is not to suggest that detailed information about the inventory and the supplier is of no interest to the organization. Obviously it is! These facts will be kept in reference files and used for such purposes as the preparation of parts lists, catalogs, bills of material, and mailing information. The inclusion of such details, however, would clutter the task of transaction processing and could prove dysfunctional, as this simple example illustrates. Other uses of data coding in AIS are to:

1. Concisely represent large amounts of complex information that would otherwise be unmanageable.

2. Provide a means of accountability over the completeness of the transactions processed.

3. Identify unique transactions and accounts within a file.

4. Support the audit function by providing an effective audit trail.

The following discussion examines some of the more commonly used coding techniques and explores their respective advantages and disadvantages.

NUMERIC AND ALPHABETIC CODING SCHEMES

Sequential Codes

As the name implies, sequential codes represent items in some sequential order (ascending or descending). A common application of numeric sequential codes is the prenumbering of source documents. At printing, each hard-copy document is given a unique sequential code number. This number becomes the transaction number that allows the system to track each transaction processed and to identify any lost or out-of-sequence docu- ments. Digital documents are similarly assigned a sequential number by the computer when they are created.

ADVANTAGES. Sequential coding supports the reconciliation of a batch of transactions, such as sales orders, at the end of processing. If the transaction processing system detects any gaps in the sequence of transaction numbers, it alerts management to the possibility of a missing or misplaced transaction. By tracing the transaction number back through the stages in the process, management can eventually determine the cause and effect of the error. Without sequentially numbered documents, problems of this sort are difficult to detect and resolve.

DISADVANTAGES. Sequential codes carry no information content beyond their order in the sequence. For instance, a sequential code assigned to a raw material inventory item tells us nothing about the attri- butes of the item (type, size, material, warehouse location, and so on). Also, sequential coding schemes are difficult to change. Inserting a new item at some midpoint requires renumbering the subsequent items in the class accordingly. In applications where record types must be grouped together logically and where additions and deletions occur regularly, this coding scheme is inappropriate.

Block Codes

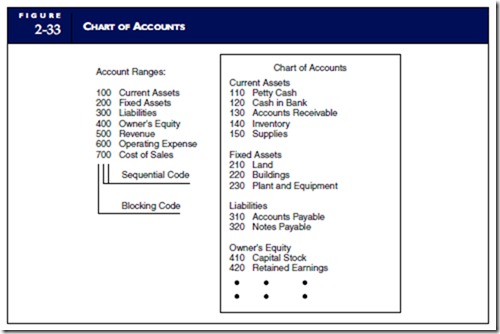

A numeric block code is a variation on sequential coding that partly remedies the disadvantages just described. This approach can be used to represent whole classes of items by restricting each class to a specific range within the coding scheme. A common application of block coding is the construction of a chart of accounts.

A well-designed and comprehensive chart of accounts is the basis for the general ledger and is thus critical to a firm’s financial and management reporting systems. The more extensive the chart of accounts, the more precisely a firm can classify its transactions and the greater the range of information it can pro- vide to internal and external users. Figure 2-33 presents an example of accounts using block codes.

Notice that each account type is represented by a unique range of codes or blocks. Thus, balance sheet and income statement account classifications and subclassifications can be depicted. In this example, each of the accounts consists of a three-digit code. The first digit is the blocking digit and represents the account classification; for example, current assets, liabilities, or operating expense. The other digits in the code are sequentially assigned.

ADVANTAGES. Block coding allows for the insertion of new codes within a block without having to reorganize the entire coding structure. For example, if advertising expense is account number 626, the

first digit indicates that this account is an operating expense. As new types of expense items are incurred and have to be specifically accounted for, they may be added sequentially within the 600 account classification. This three-digit code accommodates 100 individual items (X00 through X99) within each block. Obviously, the more digits in the code range, the more items that can be represented.

DISADVANTAGES. As with the sequential codes, the information content of the block code is not readily apparent. For instance, account number 626 means nothing until matched against the chart of accounts, which identifies it as advertising expense.

Group Codes

Numeric group codes are used to represent complex items or events involving two or more pieces of related data. The code consists of zones or fields that possess specific meaning. For example, a department store chain might code sales order transactions from its branch stores as follows:

ADVANTAGES. Group codes have a number of advantages over sequential and block codes.

1. They facilitate the representation of large amounts of diverse data.

2. They allow complex data structures to be represented in a hierarchical form that is logical and more easily remembered by humans.

3. They permit detailed analysis and reporting both within an item class and across different classes of items.

Using the previous example to illustrate, Store Number 04 could represent the Hamilton Mall store in Allentown; Dept. Number 09 represents the sporting goods department; Item Number 476214 is a hockey stick; and Salesperson 99 is Jon Innes. With this level of information, a corporate manager could measure profitability by store, compare the performance of similar departments across all stores, track the movement of specific inventory items, and evaluate sales performance by employees within and between stores.

DISADVANTAGES. Ironically, the primary disadvantage of group coding results from its success as a classification tool. Because group codes can effectively present diverse information, they tend to be over- used. Unrelated data may be linked simply because it can be done. This can lead to unnecessarily complex group codes that cannot be easily interpreted. Finally, overuse can increase storage costs, promote clerical errors, and increase processing time and effort.

Alphabetic Codes

Alphabetic codes are used for many of the same purposes as numeric codes. Alphabetic characters may be assigned sequentially (in alphabetic order) or may be used in block and group coding techniques.

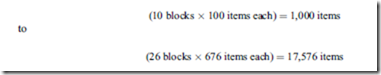

ADVANTAGES. The capacity to represent large numbers of items is increased dramatically through the use of pure alphabetic codes or alphabetic characters embedded within numeric codes (alphanumeric codes). The earlier example of a chart of accounts using a three-digit code with a single blocking digit limits data representation to only 10 blocks of accounts—0 through 9. Using alphabetic characters for blocking, however, increases the number of possible blocks to 26—A through Z. Furthermore, whereas the two-digit sequential portion of that code has the capacity of only 100 items (102), a two-position alphabetic code can represent 676 items (262). Thus, by using alphabetic codes in the same three-digit coding space, we see a geometric increase in the potential for data representation

DISADVANTAGES. The primary drawbacks with alphabetic coding are (1) as with numeric codes, there is difficulty rationalizing the meaning of codes that have been sequentially assigned, and (2) users tend to have difficulty sorting records that are coded alphabetically.

Mnemonic Codes

Mnemonic codes are alphabetic characters in the form of acronyms and other combinations that convey meaning. For example, a student enrolling in college courses may enter the following course codes on the registration form:

This combination of mnemonic and numeric codes conveys a good deal of information about these courses; with a little analysis, we can deduce that Acctg is accounting, Psyc is psychology, Mgt is management, and Mktg is marketing. The sequential number portion of the code indicates the level of each course. Another example of the use of mnemonic codes is assigning state codes in mailing addresses:

ADVANTAGES. The mnemonic coding scheme does not require the user to memorize meaning; the code itself conveys a high degree of information about the item that is being represented.

DISADVANTAGES. Although mnemonic codes are useful for representing classes of items, they have limited ability to represent items within a class. For example, the entire class of accounts receivable could be represented by the mnemonic code AR, but we would quickly exhaust meaningful combinations of alphabetic characters if we attempted to represent the individual accounts that make up this class. These accounts would be represented better by sequential, block, or group coding techniques.

Summary

This chapter divided the treatment of transaction processing systems into five major sections. The first section provided an overview of transaction processing, showing its vital role as an information provider for financial reporting, internal management reporting, and the support of day-to-day opera- tions. To deal efficiently with large volumes of financial trans- actions, business organizations group together transactions of similar types into transaction cycles. Three transaction cycles account for most of a firm’s economic activity: the revenue cycle, the expenditure cycle, and the conversion cycle. The second section described the relationship among accounting records in both manual and computer-based systems. We saw how both hard-copy and digital documents form an audit trail. The third section of the chapter presented an overview of documentation techniques used to

describe the key features of systems. Accountants must be proficient in using documentation tools to perform their professional duties. Five types of documentation are commonly used for this purpose: data flow diagrams, entity relationship diagrams, system flowcharts, program flowcharts, and record layout diagrams. The fourth section presented two computer-based transaction processing systems: (1) batch processing using real-time data collection and (2) real- time processing. The section also examined the operational efficiency issues associated with each configuration. Finally, we examined data coding schemes and their role in transaction processing and AIS as a means of coordinating and man- aging a firm’s transactions. In examining the major types of numeric and alphabetic coding schemes, we saw how each has certain advantages and disadvantages.

Comments

Post a Comment